L

O

A

D

I

N

G

L

O

A

D

I

N

G

L

O

A

D

I

N

G

L

O

A

D

I

N

G

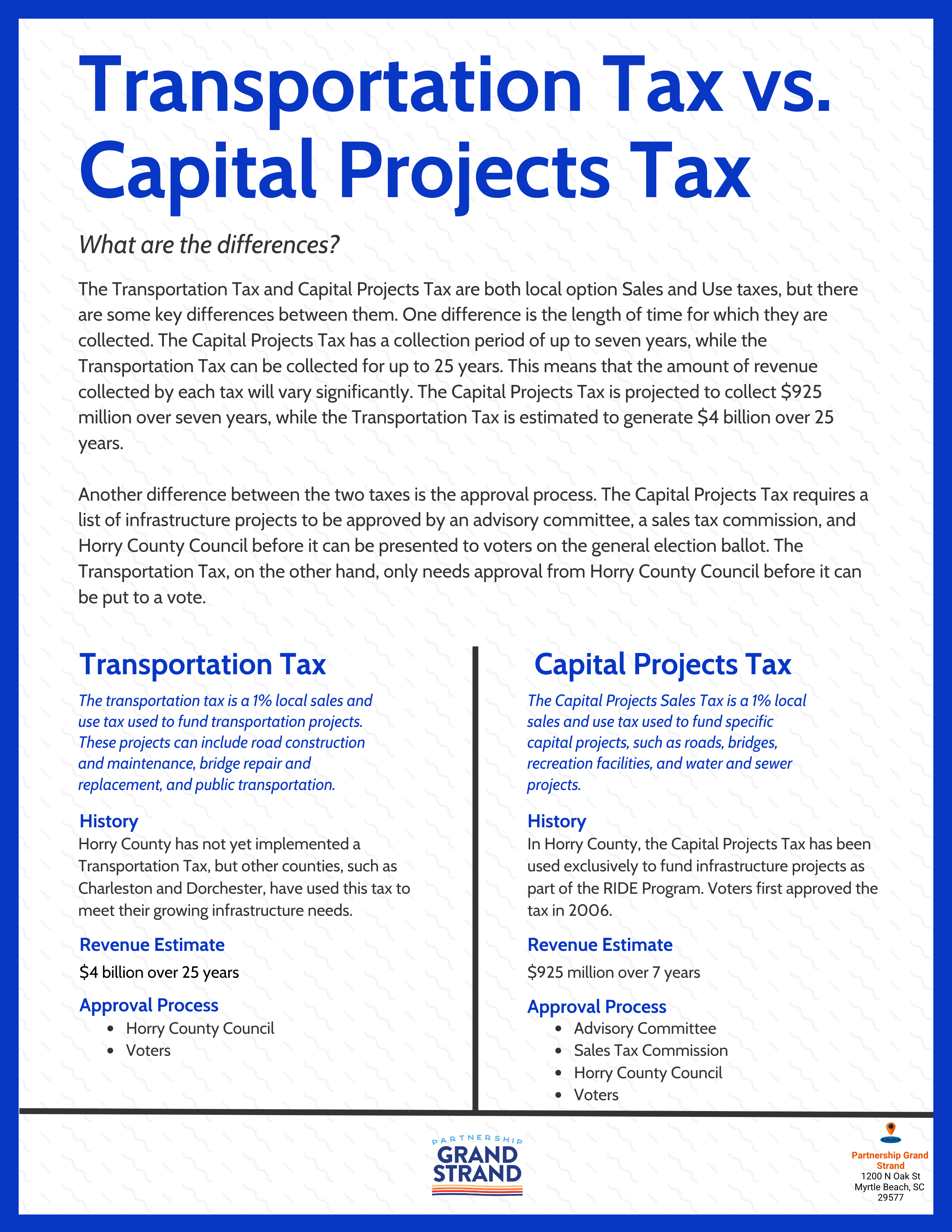

Another contrasting factor between these taxes pertains to the approval process. In the case of the Capital Projects Tax, a list of infrastructure projects must be endorsed by an advisory committee, a sales tax commission, and Horry County Council prior to its presentation on the general election ballot for voter consideration. Conversely, the Transportation Tax solely necessitates approval from Horry County Council before it can proceed to a vote.

Pursuant to the Capital Projects Sales Tax Act, Horry County Council is actively progressing with the establishment of a six-member sales tax commission. This commission will consist of three appointees from the municipalities with the highest population, namely Myrtle Beach, North Myrtle Beach, and Conway, alongside three additional representatives directly appointed by the county council. Importantly, irrespective of the Horry County Council's decision to adopt the Transportation Tax, the list of recommended road projects put forward by the sales tax commission is highly likely to be included on the general election ballot in 2024.

Quality Business Solutions (QBS) offers an integrated solution to remove the weight of payroll administration from your plate, allowing you to focus your time and resources on growing your business.

Chamber investors receive exclusive pricing on payroll management services. The QBS secure online system provides you and your employees with access to vital payroll information allowing you to run reports, print W-2s and view pay stubs all in one place, any time.